When you start your own small business, you have to make sure that you have a solid financial plan in place. Financial planning is an essential part of the success of any business.

In this blog post, we’ll explore five financial planning tips for your small business. From budgeting to investing in the right technology and taking steps to protect your assets, these strategies are designed to help you get the most out of every dollar and ensure your company’s long-term success.

1. Create a Budget

If you’re like most small business owners, you didn’t get into business to become a finance expert. But knowing how to create and stick to a budget is essential to the success of any business. Luckily, creating a budget for your small business doesn’t have to be complicated or time-consuming.

The first step in creating a budget is understanding your current financial situation. Once you have a better understanding of your company finances, it’s time to set some goals. Your budget is not set in stone — it should be flexible enough to change as your business grows and changes.

2. Manage Your Debt

If you’re like most small business owners, you’re probably carrying some debt. That’s not necessarily a bad thing – after all, debt can be a useful tool for growing your business. But if you’re not careful, it can put your business at risk.

Make sure you know exactly how much money you owe, to whom you owe it, and when it’s due. This will help you stay on top of your payments and avoid late fees or penalties. It’s also best to ask loan experts from reliable sites like https://www.nav.com/small-business-loans/.

3. Monitor Your Cash Flow

If you want to be successful in business, you need to keep a close eye on your cash flow. This means knowing how much money is coming in and going out of your business at all times.

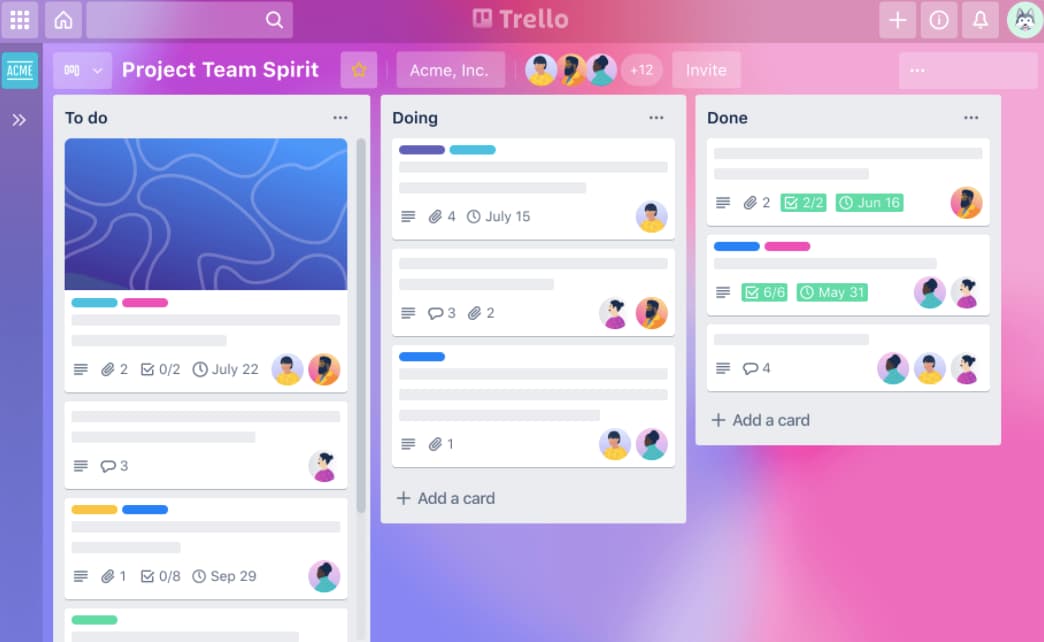

The best way to do this is to set up a system where you track your income and expenses regularly. This will help you see where your money is going and make sure that you are always aware of your financial situation.

4. Plan for Taxes

As a small business owner, it’s important to plan for taxes throughout the year. This will help you stay organized and avoid any surprises come tax time.

Know what taxes you need to pay. There are many different types of taxes that businesses need to pay, so it’s important to know which ones apply to your business. Some common business taxes include income tax, self-employment tax, property tax, and sales tax.

5. Invest in the Future

It’s never too early to start thinking about your company’s financial future. One of the best ways to ensure your company’s financial health is to invest in its future.

Think about what you want your business to achieve, and then develop a plan and budget accordingly. This will help you focus your resources on the most important aspects of your business and make sure you’re prepared for whatever challenges or opportunities come your way.

Take Note Of These Financial Planning Tips

Financial planning provides a sense of security as you plan for your future. Take note of these financial planning tips, and you can start building a strong financial foundation today.

Prepare yourself with a savings plan and monthly budget, invest wisely, and remember to stay informed. Begin your journey to financial security today! As they say, it’s never too late to start planning your financial future.

Should you wish to read more articles aside from money management, visit our blog.