CarMax Auto Finance is the financing division of CarMax, the largest used car retailer in the United States. With competitive interest rates, flexible loan terms, and purchase protection, CarMax aims to make financing a used vehicle purchase simple.

In this comprehensive guide, we will cover everything you need to know about getting financing through CarMax Auto Finance.

www.CarMaxAutoFinance.com Register, Login + Review 2024

About CarMax Auto Finance

CarMax opened its doors in 1993 to revolutionize the used car industry by offering a no-haggle pricing model and top-notch customer service. Since then, the company has grown to over 200 locations nationwide.

The CarMax Auto Finance division was created to help customers secure financing for a used CarMax vehicle purchase. They offer attractive interest rates to borrowers across the credit spectrum and allow customers to complete the entire financing process online or at a CarMax location.

Key features of CarMax Auto Finance include:

- Competitive interest rates as low as 5.75% for highly qualified borrowers

- Flexible loan terms from 24 to 72 months

- Loan amounts ranging from $500 to $100,000

- No prepayment penalties

- Online applications and tools to check rates and calculate payments

- Accepts trade-ins from other vehicles

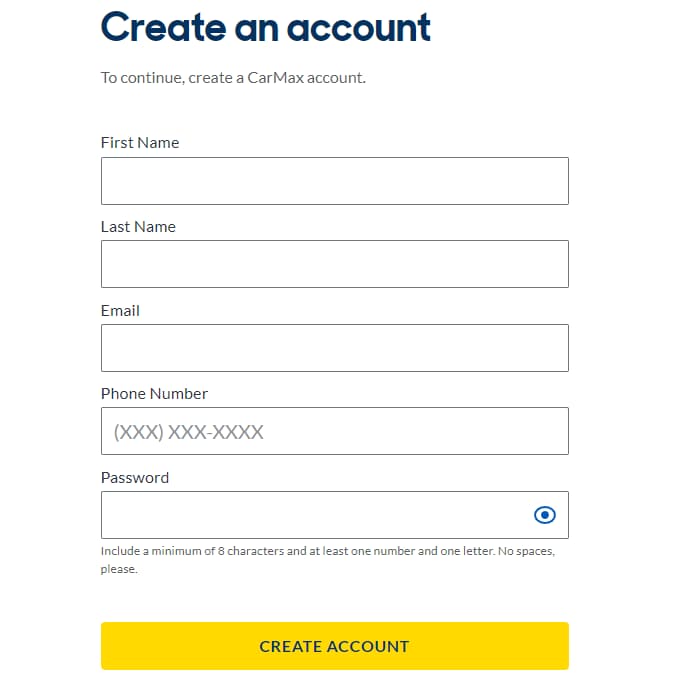

www.CarMaxAutoFinance.com Register

If you are considering financing through CarMax or have already financed a vehicle purchase with them, we highly recommend registering for an online account. Here’s what the registration process entails:

To register for a CarMax account:

- Visit the CarMax website at www.CarMaxAutoFinance.com.

- Click on “Register Now” or go directly to www.carmax.com/mycarmax/register.

- Provide your name, zip code, and email address, and create a password.

- Input your CarMax Auto Finance account number, the last 4 digits of your SSN, and your date of birth.

- Agree to the website’s terms and conditions.

- Select “Next” and follow the prompts to complete your registration.

Once registered, you can conveniently access your account statements, make one-time or recurring payments, update your details, and more.

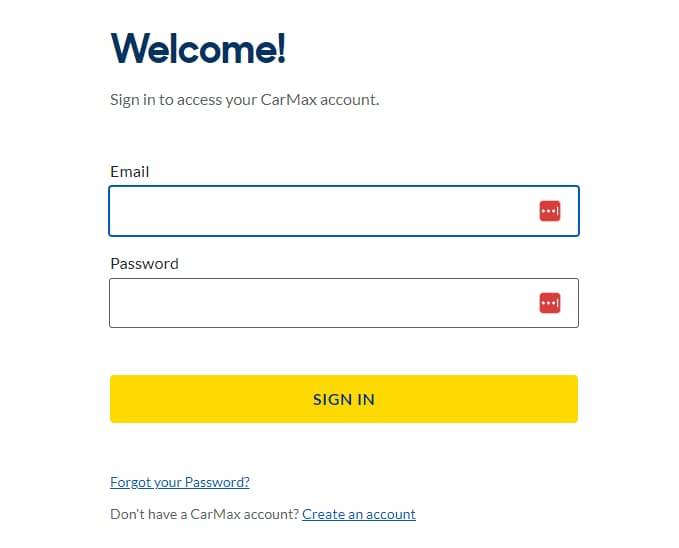

www.CarMaxAutoFinance.com Login

- To log in to your CarMax account, visit www.CarMaxAutoFinance.com and click on “Sign In” at the top right or go directly to the login page at www.carmax.com/car-financing/carmax-auto-finance.

- Enter the email address and password associated with your account.

- Read through any notifications and access the various account tools like paying your bill, reviewing statements, updating information, and more.

Key login benefits include:

- Setup recurring automatic payments

- View and download account statements

- Change due dates and update payment methods

- Edit your personal and contact information

- Pay one-time payments via different methods

Making Payments on a CarMax Auto Loan

CarMax offers various convenient payment options to choose from:

Online Payments

The fastest and easiest way to pay a CarMax auto loan is online once you’ve registered for an account.

- Go to www.carmax.com/mycarmax and sign into your account

- Under “Your Account Tools”, click on “Make a Payment”

- Choose whether you want to pay the minimum, total monthly payment, or total payoff amount

- Enter your debit card info or connect a bank account

- Confirm your details and submit the payment

Online payments are typically processed instantly or within 1 business day.

Payments by Mail

To pay your CarMax auto loan via mail:

- Make your check or money order payable to CarMax Auto Finance

- Print your name, account number, and contact info on the payment

- Mail your payment to:

CarMax Auto Finance

P.O. Box 6045

Carol Stream, IL 60197-6045

Allow 5-7 business days for mailed payments to process.

Payments by Phone

Call (800) 925-3612 to make a payment over the phone. You’ll need to provide account details like your name, address, account number, payment amount, etc.

Payments via Western Union or MoneyGram

Head to a Western Union or MoneyGram location to send your payment to CarMax Auto Finance. You’ll need to provide receive codes, CarMax’s address, your account details, and payment amount.

Carmax Auto Finance Customer Service

If you have any questions about your CarMax auto loan or the payment options, you can contact their customer support team:

Carmax Auto Finance Customer Service

- Phone: (800) 925-3612

- Fax: (770) 423-4376

- Hours: Mon-Fri 8 am–10 pm, Sat 9 am–6 pm EST

Contact the CarMax customer service line with any account questions, concerns about loan terms, assistance with registration, or general financing inquiries.

2024 CarMax Auto Finance Review: Pros, Cons, and What to Know

As one of the largest auto lenders and used car dealers in the country, CarMax offers attractive financing rates and options to used vehicle shoppers. Here is an overview of the pros and cons of financing with CarMax along with some key things to know before applying for an auto loan.

CarMax Auto Finance Benefits

CarMax auto loans offer many appealing features:

Competitive interest rates

- CarMax offers rates as low as 5.75% APR for highly qualified applicants with excellent credit, comparing favorably to top lenders.

30-day money back returns

- If you change your mind within 30 days and 1,500 miles of purchase, CarMax offers a full refund.

$500 to $100k loan amounts

- CarMax provides auto loans ranging from $500 to up to $100,000, making both small and large car purchases possible.

Fully online process

- The entire shopping, buying, and financing process can be completed online. Local delivery may also be available within 60 miles of a store.

Accepts non-CarMax trade-ins

- CarMax will buy eligible vehicles even if you aren’t buying from their dealerships. Online appraisals and purchase offers are available.

Lending to all credit tiers

- CarMax approves applicants across the credit spectrum including those with poor or fair credit in need of vehicle financing.

CarMax Auto Finance Considerations

However, there are some limitations to consider as well with CarMax auto financing:

No room to negotiate

- As a “no-haggle” dealer, CarMax does not allow negotiating down the price of vehicles. You must stick to the listed prices.

Only for CarMax used cars

- Financing is only applicable for used cars purchased through CarMax dealerships and websites.

Not available nationwide

- CarMax does not operate in Alaska, Hawaii, or several Midwestern states limiting accessibility for some buyers.

So while CarMax offers a stellar purchasing experience and financing rates to match top lenders, buyers sacrifice negotiation opportunities and flexibility in vehicle choice.

How to Apply for CarMax Auto Financing?

Here is an overview of what to expect when applying for a CarMax auto loan:

- 1. Check estimated rates and prices

Use the CarMax rate checker tool and payment calculator to estimate potential financing offers before applying formally – no credit check is required.

- 2. Select a lender

CarMax works with multiple lending partners in addition to their in-house financing arm. You could be matched with Chase, Capital One, Exeter Finance, Westlake Financial, or other lenders.

- 3. Submit loan application details

Provide personal, employment, and income details to submit a financing application for the lender’s review and approval decision. Co-applicants can also apply.

- 4. Accept loan terms if approved

If approved, you will receive loan terms including APR, repayment period, projected monthly payments, and total repayment amount to review and accept.

Then if you accept the loan offer, complete your used vehicle purchase!

How does CarMax Financing compare to Other Lenders?

CarMax offers extremely competitive interest rates, extended terms, and high borrowing limits. Still, always compare options from other lenders like credit unions and banks. LendingTree lets you easily compare personalized loan offers after a single application.

| CarMax | Carvana | Bank of America* | |

|---|---|---|---|

| APRs from | 5.75% | 7.90% | 6.54% |

| Loan terms | 24-72 months | 36-78 months | Up to 72 months |

| Loan amounts | $500-$100K | $1K+ | $7.5K+ |

| Minimum score | No minimum | No minimum | 700+ credit score |

*For Bank of America rates, a minimum credit score applies.

As you can see, CarMax has the lowest starting rate of the group while providing very flexible terms and no minimum score requirement. So buyers across the credit range can qualify for competitive financing offers through CarMax for their used car purchases.

Is a CarMax Auto Loan Right for You?

Given the ease of purchase, attractive interest rates across credit tiers, and built-in refund period, CarMax vehicle financing will likely meet the needs of most used car shoppers.

Here is a recap of some factors to consider before applying for CarMax financing:

Best for:

- Low credit borrowers in need of financing

- Those wanting to complete the buying process online

- Used car buyers wanting purchase protection

May not be best if:

- Do you want to negotiate vehicle prices

- Have specific model/new car preferences

- Reside outside CarMax service states

So while CarMax auto loans don’t fit every buyer, they provide a stellar option for most people shopping for financing on a CarMax-sourced used vehicle. The high approval likelihood, online process, and purchase guarantees provide peace of mind throughout the shopping journey.

FAQs about CarMax Auto Loans

- Does CarMax have special financing offers?

Yes, CarMax frequently has special rate promotions advertised on its website for qualified buyers. Offers can include 1.9% APR for select loan terms or 90 days of no payments.

- How long do you have to return a CarMax car?

CarMax provides a 30-day money back guarantee (up to 1,500 miles driven) on used vehicle purchases, giving you a month to change your mind with no penalties.

- Can I get pre-approved for CarMax financing?

Yes, you can get pre-approved directly through CarMax’s website. Their online pre-qualification tool gives you an estimated rate and loan amount for which you may qualify—without affecting your credit score.

- Does CarMax take trade-ins?

Yes, CarMax accepts non-CarMax trade-in vehicles. You can get a value estimate online or in-store without any obligation to sell. If you accept their offer, CarMax will seamlessly apply the trade-in value to your purchase.

- Can I refinance my current auto loan through CarMax?

Unfortunately, CarMax only finances vehicles purchased from CarMax dealerships. For an existing car loan, you would need to apply with another lender like a bank, credit union, or online lending marketplace.

Also Check:

- Kaelo Money Login

- Target.con/CheckBalance

- MyBJPerks Mastercard Credit Card Login

- www.AspireCreditCard.com Acceptance Code

Conclusion:

With quick online tools to estimate payments, flexible terms for all credit ranges, purchase protections like 30-day returns, and financing fully integrated into the car buying journey, CarMax Auto Finance aims to simplify and streamline financing for used car shoppers.

By pre-approving borrowers online and offering access to various lending partners, CarMax auto loans provide nationally competitive rates too. Just note the trade-offs—set pricing leaves no room for negotiation and vehicles must be purchased from CarMax affiliated dealers.

Overall, CarMax Auto Finance delivers a premier financing experience for most used vehicle buyers needing flexible, easy, and fast financing options.

The high approval odds and integrated lending process make shoppers across the credit spectrum feel confident throughout the financing and buying process when using CarMax.